The Institutes has released an updated version of CPCU 530, with a new course title: CPCU 530: Applying Legal Concepts to Insurance. Keep scrolling to see our full review and a list of how the topics have changed.

Summary of changes:

- Chapter 3 (basics of contract law) is removed

- Chapter 12 (types of business entities) is removed

- Various topics from the remaining chapters are removed

- Discussion of almost every topic is significantly pared down

- New topics (policy contract format) added

- Very inconsistent number of practice questions between chapters

- Major changes to simulated exam

Exam information:

- For third quarter (Q3) test window: Exam is based on the current version of the course (titled CPCU 530: Navigating the Legal Landscape of Insurance). The last day to test on this version of the exam is September 15, 2023.

- For subsequent test windows: Exam will be based on the new version of the course (titled CPCU 530: Applying Legal Concepts to Insurance).

Details of overall changes:

1) Improved visual look: The new interface is more colorful and visually appealing.

2) Majority of content is still text: About 90% of the course content is still text-based, meaning you still have to do a lot of reading.

This is very surprising because The Institutes had stated on their CPCU FAQ page that “the learning experience is being updated to match the needs of today’s busy adult learner—including more videos and interactions to help students acquire and retain the skills they need to be leaders.” We did not find any interactive modules within the assignments themselves, and the practice quizzes & practice exam did not appear to have any changes. The only portion of the course that included a new style of activity was the simulated exam, which we discuss in further detail in #6 below.

On a side note regarding the video content: you do have the option to turn on captions and change the speed of the video. We found the videos much easier to watch at a faster speed and with the captions on.

3) Topics carried over from expiring course are significantly pared down: The topics still being covered in the new course have far less detail.

Many of the topics from the expiring course still appear in the new one, but the level of detail for nearly all of those topics has been drastically reduced. For example, if the expiring course had devoted several pages to a topic, that same topic might be covered in only a few sentences in the new course. Only a handful of topics had slightly more detail than before.

4) Incredibly long chapters: Despite paring down the content by roughly 3 chapters, the 6 new chapters are still very, very long.

CPCU 530 is well-known for having a ton of content to get through, and the new course version still has a lot of material. The new course essentially condenses about 9 already-long chapters into 6, so you are looking at very, very long chapters. For this course in particular, we recommend allocating double the time that you normally spend per chapter on other courses.

5) Very inconsistent number of chapter quiz questions: Some chapters had only 6 questions, whereas others had 30-40 questions.

Some chapters barely had any questions, while other chapters continued to provide new practice questions even after 6-7 quiz attempts. We highly recommend retaking the chapter quizzes multiple times so you can try to access all the questions in the question bank. Unfortunately, you may only see a few new questions per quiz attempt, but doing more practice questions is so valuable to the learning process that we think it is worth the effort to get to every question available.

6) Simulated exam:

In the newer course, the simulated exam uses the same interface as the actual exam, so it does a much better job of mimicking the true exam experience.

More importantly, the simulated exam included non-multiple choice questions, such as type-in-the-blank, drag-and-drop, and multi-choice multiple choice questions (where more than one of the answer choices is correct). For a detailed discussion of these question types, see our post Virtual exam information.

We did email The Institutes to inquire if the actual exam will include these new question formats, and they responded that “No changes have currently been made to designation credentialing exams or the corresponding grade reports.”

One more thing worth noting about the simulated exam is that once you finish the test, review what you got wrong, and close out of it, you can no longer access the exam attempt again to re-review the questions.

List of topics covered:

The list below shows the main topics covered in the expiring course, CPCU 530: Navigating the Legal Landscape of Insurance. We have noted what topics have been removed and where the remaining topics appear in the new version of the course as follows:

- Sections that do not appear in the newer course with the same level of detail are stricken out (in some cases, minor references to the same topics may still appear in the new course in other places)

- Which chapter each topic can be found under in the new course

- List of new topics that are not covered in the expiring course

Note: We do not provide any guarantees or warranties regarding the accuracy and comprehensiveness of this list.

Chapter 1: [about US legal system]

- Overview of US common law

- Ways to classify US law

- 5 sources of law [only section on administrative agencies was kept, Chapter 6]

- Civil trial procedures [chapter 6]

- Alternative dispute resolution [chapter 6]

Chapter 2: [contract law, part 1]

- Types of contracts [chapter 1]

- Elements of a contract [chapter 1]

Chapter 3: [contract law, part 2]

- Statute of frauds

- Parol evidence rule

- How courts interpret contracts

- Assignment of contracts

- Third-party beneficiaries

- How a contract can end

- Types of contract breaches

- Types of contract remedies

Chapter 4: [applying contract law]

- Characteristics of insurance contracts [chapter 2]

- Unique aspects of insurance contract formation [chapter 2]

- When third-parties benefit from insurance [chapter 2]

- Representations vs warranties [chapter 2]

- Ways an insurer can forfeit a defense or right [chapter 2]

Chapter 5: [commercial law]

- Types of specialized sales contracts

- Formation of sales contracts

- Issues surrounding sales contracts [chapter 1]

- Negotiable instruments

- Documents of title [chapter 1]

- Secured transactions

- Fair trade laws [chapter 1]

- Consumer credit laws [chapter 1]

- Bankruptcy [chapter 1]

Chapter 6: [property law]

- Intellectual property [chapter 3]

- Accession [chapter 3]

- Confusion [chapter 3]

- Gifts [chapter 3]

- Bailment [chapter 3]

- Real property ownership [chapter 3]

- Real property sales [chapter 3]

- When others have may financial interest in your property [chapter 3]

- Incidental property rights

- Land use restrictions

- Landlord-tenant relationships

Chapter 7: [tort law, part 1]

- Elements of negligence [chapter 4]

- Proving negligence [chapter 4]

- Defenses against negligence

- Negligence for landowners [chapter 4]

- Intentional torts [chapter 4]

Chapter 8: [tort law, part 2]

- Data & cybersecurity laws

- Strict liability [chapter 4]

- Product liability [chapter 4]

- Types of damages [chapter 6]

- Other tort concepts [chapter 6]

- US laws that affect international business

Chapter 9: [agency law]

- How agency relationships are created [chapter 5]

- Scope of authority [chapter 5]

- Duties owed by agents/subagents/principals [chapter 5]

- Termination of agency relationships

- Liability for contracts involving third-parties [chapter 5]

- Principal’s liability for agent’s acts [chapter 5]

Chapter 10: [applying agency law]

- Types of insurance producers [chapter 5]

- Producer authority [chapter 5]

Chapter 11: [employment law]

- Employment at will [chapter 1]

- Anti-discrimination laws [chapter 1]

- Labor-management relations & unions

- Employee welfare laws [chapter 1]

Chapter 12: [types of business entities]

- Corporations

- Partnerships

- Other types of business entities

[new topics in updated course]

- How insurance policies are constructed [chapter 2]

- Consideration in insurance contracts [chapter 2]

- Other documents that may be part of policy [chapter 2]

- Analyzing policy contracts [chapter 2]

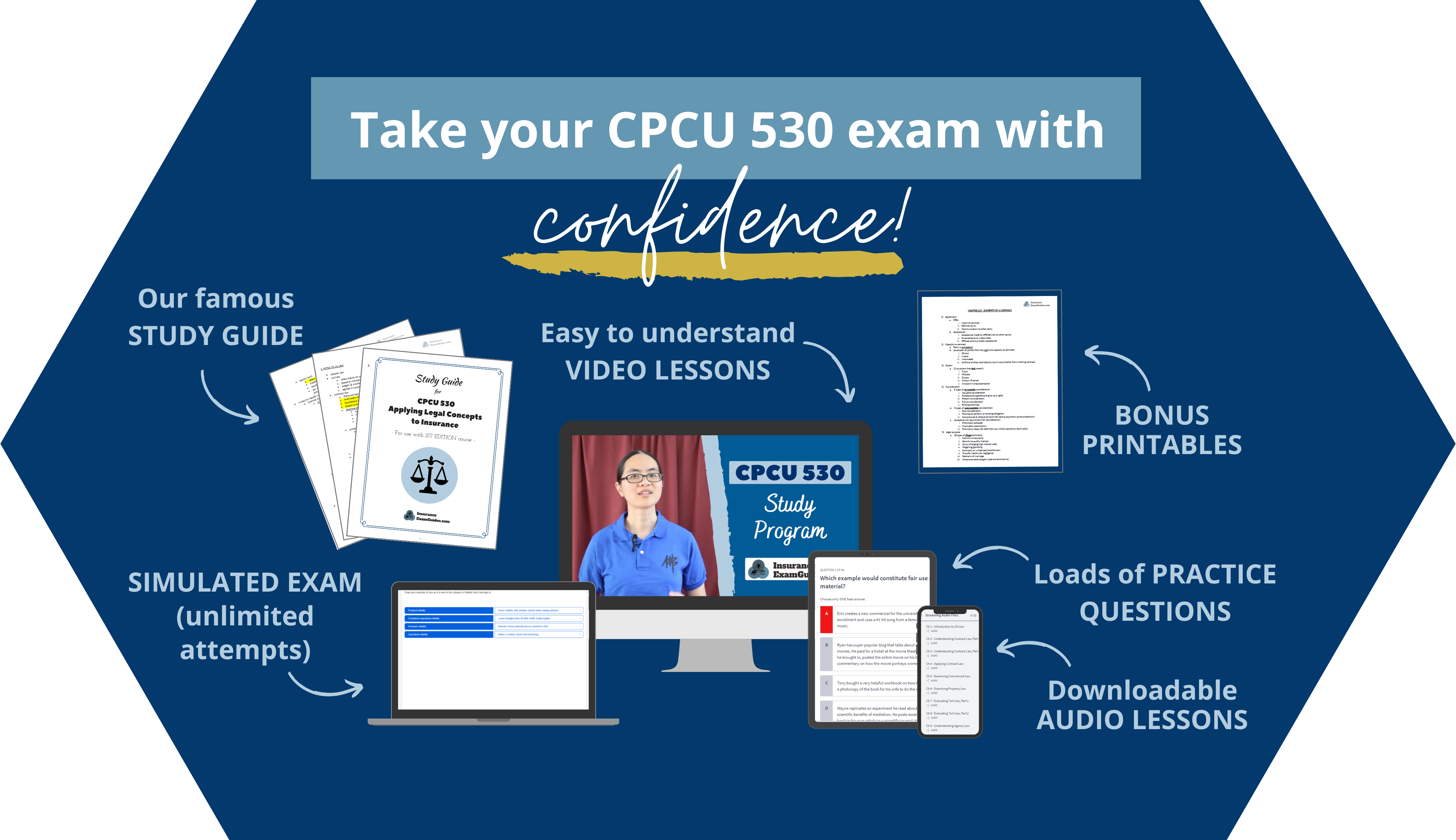

Frequently asked questions (FAQ) for IEG products

Which course version is IEG products based on?

- We have updated our study materials to reflect the new course. When clicking the “Buy Now” button, the updated study materials will be added to your shopping cart.

- All students who are enrolled in the expiring version of our study program can request a free upgrade to the updated version by emailing us at info@insuranceexamguides.com

How can existing customers get access to the new study materials?

If you bought a study guide bundle: Use the download link you received in your order confirmation email to download both versions. We have also emailed all prior customers with these same instructions.

If you bought an online study program: Please email us at info@insuranceexamguides.com from the email address you use to sign on to request enrollment in the updated course.

Get a free study plan generator and CPCU progress tracker!

Join our mailing list and score these free tools.

Get your CPCU 530 study materials NOW!

Looking for our printables-only package? Click here.

Why our study programs work

Lots of companies offer study materials too, but here is why our study programs stand out:

See the concepts in action

You will be tested on your ability to apply the concepts to different situations, so we provide plenty of examples to show you how things work.

Less is NOT always more

Some things won't make sense until you have enough background info. We give extra context where you'd need it to fully grasp the material.

Learn AND remember

Besides learning the content, you have to remember it all. Our paid study programs include our famous study guides that make it super easy to refresh your memory.

About your instructor

Insurance Exam Guides (IEG) was founded by Stacy Trinh, CPCU®, who first started her teaching journey at the request of her co-workers who were preparing for their CPCU exams. Because of her reputation as an adept trainer and motivator, Stacy's co-workers had asked her to lead a class. The feedback on her sessions and study materials was overwhelming positive, and her students encouraged her to share what she had to offer with the rest of the CPCU community.

Since then, Stacy created a library of study materials for both CPCU® and AINS® that have helped thousands of students pass their exams. As an accounting major and former claims adjuster, her style of instruction incorporates both a financial and operational perspective that makes her study materials well-rounded. She looks forward to helping many more students continue to succeed, including you!

Disclaimers: The Institutes, CPCU®, and AINS® are trademarks of the American Institute For Chartered Property Casualty Underwriters, d/b/a The Institutes. InsuranceExamGuides.com is not affiliated or associated with The Institutes in any way, and The Institutes do not endorse, approve, support, or otherwise recognize InsuranceExamGuides.com or its products or services. CPCU® and AINS® are registered trademarks of The Institutes. All rights reserved.